When you’re thinking about whether to borrow money to invest into your business, a key consideration will be cost. If the cost of borrowing is reasonable, you may be able to take out a loan, invest in growth and make a good profit. However, if the cost is too high it may you may not be able to make the returns to justify borrowing.

Here we help you consider the factors that affect the cost of an unsecured business loan.

Risk profile

Practically every business decision is ultimately a question of assessing risk against return. Lenders are running businesses just like the rest of us, so their assessment of your company’s risk profile is absolutely fundamental to the cost of borrowing.

Many lenders categorise clients and potential clients into one of three risk bands. For our own convenience, we will call these Low, Medium and High, although lenders will probably use something less emotive, such as A, B or C.

- Low risk: Strong personal credit score, strong business credit score, trading for 5 years or more, good profits, good balance sheet net worth

- Medium risk: Reasonable personal score with only minor issues, reasonable business credit score, trading for 2 years or more, profitable

- High risk: Some recent credit issues or weak credit score (missed payments or satisfied CCJs)

The period of the loan will also impact the overall risk, and therefore the interest rate that will be charged. Lenders will look at these two factors to arrive at an appropriate interest rate. The following figures are based on current market trends, to give you an idea of how the duration of the loan and the borrower’s risk profile can affect the cost of borrowing:

| Loan term | Low risk | Medium risk | High risk |

| <1 year | 3-7% | 8-14% | 15-40% |

| 1-3 years | 4-8% | 9-15% | 15-25% |

| 3-5 years | 5-9% | 10-16% | n/a |

These rates are annual, and are for illustration only. Typically, terms of 3 or more are not available for high risk applications.

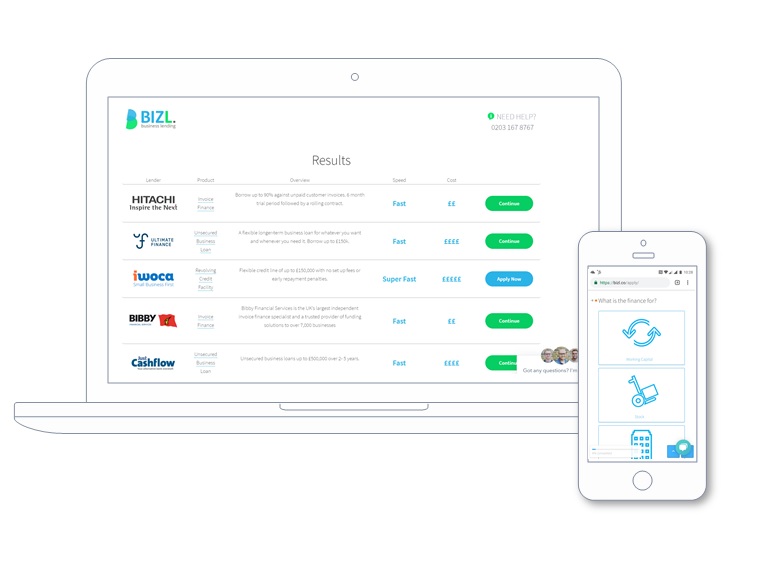

See your options now

- Apply in 60 seconds

- See which lenders can help

- No obligation

Viewing your options has no impact on your credit score

How to get the best business loan rates

While the above figures are for illustrative purposes only, one thing that is immediately obvious is the higher the risk profile, the higher the cost of borrowing. It may be the case the cost of borrowing is not an issue, as speed and ease are of more importance for your business. However, if time is on your side, there are a few ways in which you can lower the cost of borrowing by reducing your risk profile:

- Pay some attention to your business credit score. By taking a few simple steps you could significantly reduce your perceived risk to lenders.

- Your personal credit score can also have a big impact on how lenders assess your risk. Again, there are some quick wins to start improving your score, as well as some slow-burner strategies.

- Offer up some form of security, typically property. In doing so, the risk to the lender immediately reduces, as there is a safety net in place to ensure they are able to get some or all of their money back in the event that you default on the payments.

Let’s look at the same loans over the same periods for the same risk profiles. But this time, with security in place:

| Low risk | Medium risk | High risk |

| 3-5% | 4-6% | 5-10% |

Again, these are annual rates and are for illustration only.

The impact of providing security on interest rates can be a compelling reason to consider using a property as collateral. It is, however, also worth taking into account the additional time it will take to arrange a secured loan. There will also be valuation and conveyancing costs to bear in mind.