Commercial Mortgages

Use it to buy, build, expand, remodel, or even refinance.

Ready to go?

Apply in 3 minutes. One of our Commercial Mortgage Specialists will then guide you through your options.

Loan Amount

£100k-£5,000,000

Loan Term

Up to 25 Years

Time to Funds

As Little as 30 Days

Interest Rate

From 2.5%

A commercial mortgage could be the foundation of your small business.

Investing in your business premises is a great way to build long-term value for your future. By taking out a commercial mortgage you can go from paying rent for someone else’s property, to building equity in your own asset.

What You Need to Know

A commercial mortgage is a particular type of business loan, where the funds lent are secured against a commercial property. These mortgages can be secured against investment properties, in the case of buy to lets, or commercial properties intended to serve as your own business premises. The mortgage can be used to purchase the property, to refinance an existing mortgage, or to release equity from the property.

What is a commercial mortgage?

A commercial mortgage loan is a mortgage, where the debt is secured via a business property. The property may be the very heart of a business’s headquarters, or it could be a premises which is rented out in order to bring in another income for the organisation.

If you’re wondering what the difference is between a residential and a commercial mortgage, the answer lies in the property itself. Residential mortgages are loans taken out by a single person or family, to purchase a property to live in. On the other hand, commercial mortgages are loans taken out by businesses or landlords, in order to purchase property which will boost their business.

Commercial mortages can be taken out directly in the business name (whether you’re a sole trader, partnership or Limited Company), or it can be taken out under another entity. For example, we often help directors buy a property in their personal name and then let it to their Limited Company.

Recently completed Commercial Mortgages

- £600,000

- Wholesale

- 2.3% variable

- 50% Loan to value

- £770,000

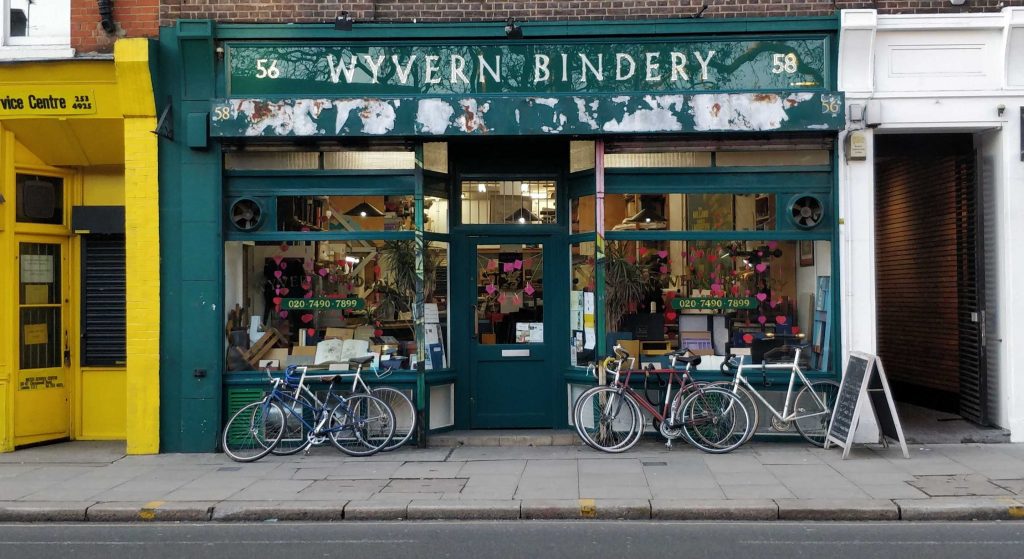

- Retail

- 2.54% variable

- 75% Loan to value

- £370,000

- Post Office

- 3.56% fixed

- 70% Loan to value

Read our Client Stories

Find out about how we’ve supported SMEs and property professionals across a range of sectors and situations

How does a commercial mortgage work?

Lenders will need to verify that the business can afford to meet the monthly mortgage repayments, along with assessing your business against their specific criteria. Once approved, they’ll send a valuer out to confirm the value of the building and then their solicitors will set about the legal work.

Do I qualify for a commercial mortgage?

Commercial mortgages aren’t available to any business that wants one. All lenders have a strict set of criteria that a company must meet in order to be considered for such a loan. The list of eligibility checks that lenders use to decide whether or not to lend include assessments of a company’s finances, debts and cash flow.

Lenders will calculate a projected income for a company, and consider whether or not they believe that a company will be able to repay their debt. If a premises is to be rented out, then expected rental income will be taken into account at this stage. Following eligibility checks, a lender might adjust the required deposit before proceeding.

Typically you’ll be eligible for a commercial mortgage if you’ve been trading for more than 2 years, you have a sufficient deposit saved and you can show a track record of making profit.

Commercial Mortgage Calculator

Use our commercial mortgage calculator to work out what a business loan will cost you as well as how much a lender may be willing to lender to you.

How much deposit do I need?

Commercial mortgages require a hefty deposit, and that should be a major consideration before the mortgage hunt begins. The amount that you’ll need varies, depending on what the lender thinks you’ll be able to afford, and what type of property you’re hoping to buy.

Usually a commercial mortgage deposit will fall between 20% and 40% of the overall purchase price. Of course, many businesses hope to pay the smallest possible deposit, so it’s well worth shopping around to establish the amount that different lenders are able to offer. In some cases you may be able to fund the entire purchase price by offering a second property as security to a lender.

How quickly can I get a commercial mortgage?

Arranging a commercial mortgage is a complicated business, and as you might expect there’s a fair amount of paperwork involved. We’re often asked how long it takes to arrange a commercial mortgage, but there’s no simple answer to this one.

What are the best rates for commercial mortgages?

Which lender has the best commercial mortgage rates? It’s a good question but the answer depends on your specific situation. Interest rates vary between lenders based on their view of the risk profile of your business. Lenders have their own risk appetites and scorecards, but a helpful way to get an idea of what interest rate your business could get is to think in terms of “risk bands”:

- Risk band A: Strong personal credit score, strong business credit score, trading for 5 years or more, good profits, good balance sheet net worth. Low loan to value.

- Risk band B: Reasonable personal score with only minor issues, reasonable business credit score, trading for 2 years or more, profitable. Higher loan to value.

- Risk band C: Some recent credit issues or weak credit score (missed payments or satisfied CCJs)

In addition to working out which category you’d fit into, lenders will also price your loan very differently depending on the type of property being funded, as well as the loan to value. The higher the loan to value, the higher the interest cost.

So you could expect rates as follows:

- Risk Band A: 7%-9% p.a. fixed for 5 years. Alternatively 2%-3% above base rate. These rates would typically be available with high street lenders and some specialist lenders only available through commercial mortgage brokers.

- Risk Band B: 8%-10% p.a. fixed for 5 years. Alternatively 3%-4% above base rate. These rates tend to be available via challenger banks and some specialist lenders.

- Risk Band C: 9%-12% p.a. fixed for 5 years. Alternatively 4%-6% above base rate.

These rates are annual, and are for illustration only.

Compare commercial mortgages

NatWest commercial mortgages

Borrow from £25,001; Fixed and variable interest rates available; Repayment terms up to 25 years; No early repayment charges, conditions apply; Repayment holiday available, subject to approval; Capital & Interest or Straight Line repayment profiles available; Arrangement and security fees may apply.

Lloyds commercial mortgages

Apply for a minimum of £25,001 and choose a term loan from 3 to 25 years. Borrow up to 70% of the property value. Choose between fixed or variable interest rates to suit your business needs. Capital repayment holidays may be available.

Barclays commercial mortgages

Choose any repayment from 1 to 25 years. Choose a variable or fixed-rate mortgage. You can switch from a variable to a fixed rate.Option to take an interest-only period, subject to status and application. Fixed-rate mortgage available for 10 years.

Your funding is waiting.

Talk to one of our Commercial Mortgage Specialists. We’re on hand to take you through the options available.