Trade Finance

Funding to pay suppliers and fulfil purchase orders

Ready to go?

Apply in 3 minutes. One of our Business Finance Specialists will then guide you through your options.

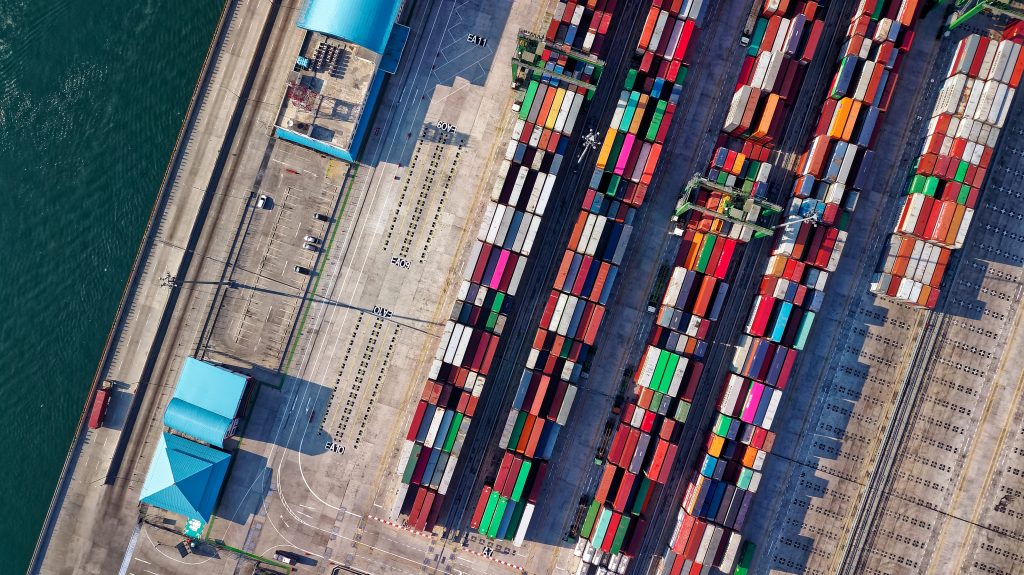

Trade FInance

Funding to pay suppliers and fulfil purchase orders

Ready to go?

Apply in 3 minutes. One of our Business Finance Specialists will then guide you through your options.

Funding Amount

£5k-£10m

Cost

0.2% - 3% per month

Payment terms

Borrow up to 150 days

Upgrade your working capital with Trade Finance

Trade finance helps businesses deliver on their purchase orders by funding supplier payments.

Keeping cash flow healthy is absolutely vital for business success. Running out of cash is the nightmare scenario that keeps many business owners awake at night. If you have growth plans, it’s not just a case of ensuring there is enough cash in the bank to survive. You also need sufficient working capital to take advantage of any new opportunity that comes along. Trade finance is a useful tool that covers both of these bases.

How does trade finance work?

Trade finance provides instant funds on the basis of work or orders that your client will pay for at a future date. Typically, trade finance is available on a confirmed order basis. So if you have a purchase order from a customer, for example, trade finance will provide the cash you need to fulfil it. This can include procuring the materials, provide the product or service and deliver it to the customer. For this reason, trade finance is sometimes referred to as purchase order finance. It’s also known as Supply Chain Finance, as the credit supports the whole supply chain.

Read our Client Stories

Find out about how we’ve supported a women’s fashion wholesaler with trade and invoice finance

What are the terms?

Interest rates will vary on a case by case basis, as the risk to the lender depends on the reliability of the supplier and the buyer you are working with. Typically, however, you will be looking at an interest rate that is somewhere around the one to two percent mark per 30 days. The amount you can borrow depends on the size of the purchase order, and the repayment terms are usually up to 120 days. The good thing about trade finance is that it is very much a bespoke type of funding, so these are just illustrative figures.

Am I eligible for trade finance?

Any B2B business buying stock from one business and selling to another business is likely to be eligible for trade finance. As the financing is on the basis of other parties in the supply chain, a sketchy or less than perfect credit history needs not be a barrier to taking advantage of this kind of facility. In that respect, it is a form of credit that focuses very much on the here and now. The lender is less concerned about what’s happened in the past, or what assets you have or haven’t got on your balance sheet. They are more concerned about the transaction that will underpin the finance. How much is it worth, who are the other parties involved and just how much benefit is it going to deliver to your business?

Having said that stronger borrowers will be those with a balance sheet net worth more than £100k, turnover above £1m and trading for at least 2 years. If you’ve got a track record of fulfilling purchase orders then that’s a real plus too.

Can I get trade finance without purchase orders?

Typically trade finance providers lend against purchase orders, suiting B2B scenarios. But what if you are a retailer, selling your product B2C, and so you don’t have purchase orders? The good news is that there are trade finance options suited to retail which don’t rely on purchase orders. The trade finance facility works in exactly the same way, with the financing provider paying your supplier, but you don’t need a purchase order to obtain the funding.

Using trade finance with invoice finance

Trade finance can dovetail well with other types of funding, particularly invoice finance. While trade finance bridges the gap between ordering the materials or stock you need to deliver your product or service, the latter helps you through the time between invoicing your customer and them settling the bill. Here’s how trade finance typically works alongside invoice finance:

- Purchase order received from your client for your product

- You place an order with your supplier

- Trade finance lender pays your supplier when the stock is ready to be shipped

- You receive stock and sell onwards to your client

- On raising your invoice your invoice finance facility kicks in and repays the outstanding trade finance

- Your client pays your invoice, paying off the outstanding invoice finance borrowing

Letters of Credit

An Import Letter of Credit, often simply referred to as a Letter of Credit (LC), is a financial instrument commonly used in international trade to facilitate secure transactions between importers and exporters. It is a guarantee provided by a bank on behalf of the buyer (importer) to the seller (exporter) that payment will be made for the goods or services once certain conditions are met.

Here’s how it typically works:

-

Agreement: The buyer and seller agree to use a Letter of Credit as the method of payment in their international trade transaction. This agreement is often stipulated in the sales contract or proforma invoice.

-

Opening the LC: The buyer (importer) applies to their bank to open an Import Letter of Credit in favor of the seller (exporter). The bank acts as an intermediary and guarantees payment to the seller upon complying with the terms and conditions of the LC.

-

LC Terms and Conditions: The LC outlines specific terms and conditions that must be met by the seller for payment to be released. These terms can include details about the quality, quantity, and description of the goods, shipping and delivery dates, documentation requirements, and more.

-

Shipment and Documentation: The seller prepares the goods for shipment and ensures that all required documents (e.g., bill of lading, commercial invoice, packing list, certificate of origin) are in accordance with the LC’s terms.

-

Presentation to the Bank: The seller submits the required documents to their bank (the advising or confirming bank) for examination. The bank reviews the documents to ensure they conform to the LC’s terms.

-

Payment: If the documents are in compliance with the LC, the bank will make payment to the seller. If there are discrepancies, the bank may reject the documents or request amendments from the seller.

-

Delivery of Goods: Once payment is made, the seller ships the goods to the buyer.

The Import Letter of Credit offers security to both the buyer and seller. The buyer knows that payment will only be made when the agreed conditions are met, ensuring that they receive the goods as specified. The seller has the assurance of payment as long as they fulfill the LC’s requirements. The banks involved play a crucial role in facilitating the transaction and mitigating risks associated with international trade.

Recently completed Trade Finance facilities

- £100,000

- Fashion wholesale

- 2% p.m.

- £300,000

- Equipment wholesale

- 0.8% p.m.

- £950,000

- Import of paper

- Letter of Credit

Your Trade Finance facility is waiting.

Talk to one of our Business Finance Specialists. We’re on hand to take you through the options available.