Growing your business takes blood, sweat and tears…and more often than not, a good deal of cash. How do you get the right funding in place for your business, and how do you maximise your chances of getting approved for a small business loan?

Funding a business means either spending working capital, raising cash from investors or borrowing from a third party. The first can take time and present risks of its own. The second means relinquishing a degree of control to the investors and exposing the business to their expectations in terms of returns. Borrowing is often the best way to raise capital without diluting ownership or exposing the business to cash flow risks.

The mighty small business loan

Of all the different types of financial products available to businesses, a small business loan will be the most familiar. They are conceptually similar to personal loans in as much as there are plenty of different options out there depending on how much you want to borrow and over what period.

On average small business loans are amounts up to £25,000, but can be as small as £1,000, and as high as £150,000. (You probably can’t refer to larger amounts as “small”!) You typically repay small business loans over a period of 12 months to 5 years depending on the purpose. This means you can invest the capital in your business now, and then repay as your businesses grows.

Of course, eligibility criteria also comes into play, especially when it comes to an unsecured business loan. Lenders will consider your personal credit history and business credit history to assess your eligibility. If the checks show you have a glowing history and a healthy credit score, the best options will be laid out before you.

Small business loan eligibility

When applying for a business loan, it is always better to provide as much information as possible to potential lenders. If you are up front this will not just mean they are better informed, it will also increase their level of trust and confidence in your business. Ensure the following are clearly provided in your loan application:

- Purpose of loan

- Key financial figures for business, such as turnover and profit

- Trading history

- Filed accounts

- Credit history, including any negatives such as CCJs or late payments

These are just the bare essentials. Some lenders might ask for this information in summary, while others will pose far more searching and in-depth questions.

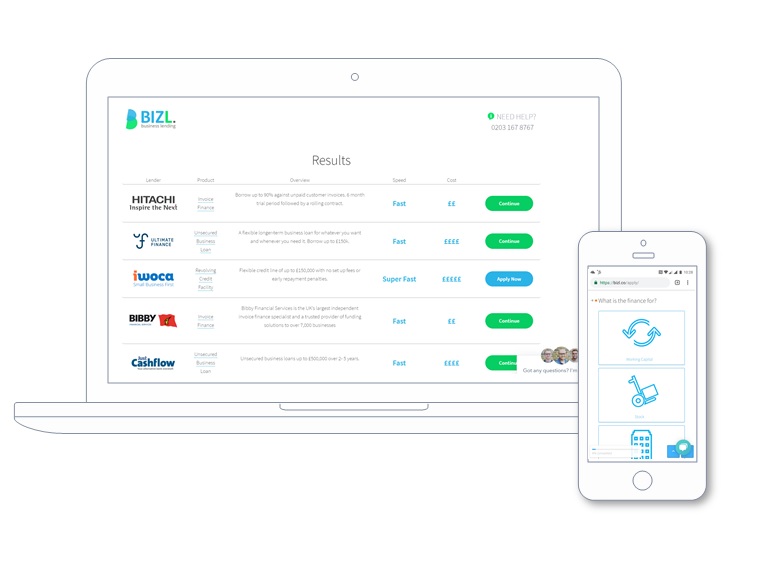

See your options now

- Apply in 60 seconds

- See which lenders can help

- No obligation

Viewing your options has no impact on your credit score

Will you be accepted?

There are a few guidelines worth considering that can provide an indicative answer to this question. In general, lenders will be more likely to approve your loan if the following conditions are met:

- The loan amount is less than 25% of annual turnover

- The business has been trading for more than two years

- The company is profitable, and your annual profit is more than the annual loan repayments

- There are no adverse factors such as CCJs

Alternative funding options

If you don’t meet one or more of the above criteria, that doesn’t rule you out. It simply means that there might be fewer choices on the table, and potentially you will be faced with a higher interest rate. Consider what steps you’d need to take to get closer to the eligibility criteria. It may be worth holding on for a few months if you can make some positive changes.