Purchasing commercial property can be a significant investment for businesses, offering both potential financial returns and operational advantages. One strategic approach that has gained popularity among business owners and investors is the OpCo/PropCo (Operating Company/Property Company) structure. This arrangement involves separating the ownership of the operating business from the ownership of the property. In this blog, we’ll explore the key aspects of this structure, its benefits and challenges, and considerations to help you determine if this structure is the right choice for your commercial property investment.

Understanding the OpCo/PropCo Structure

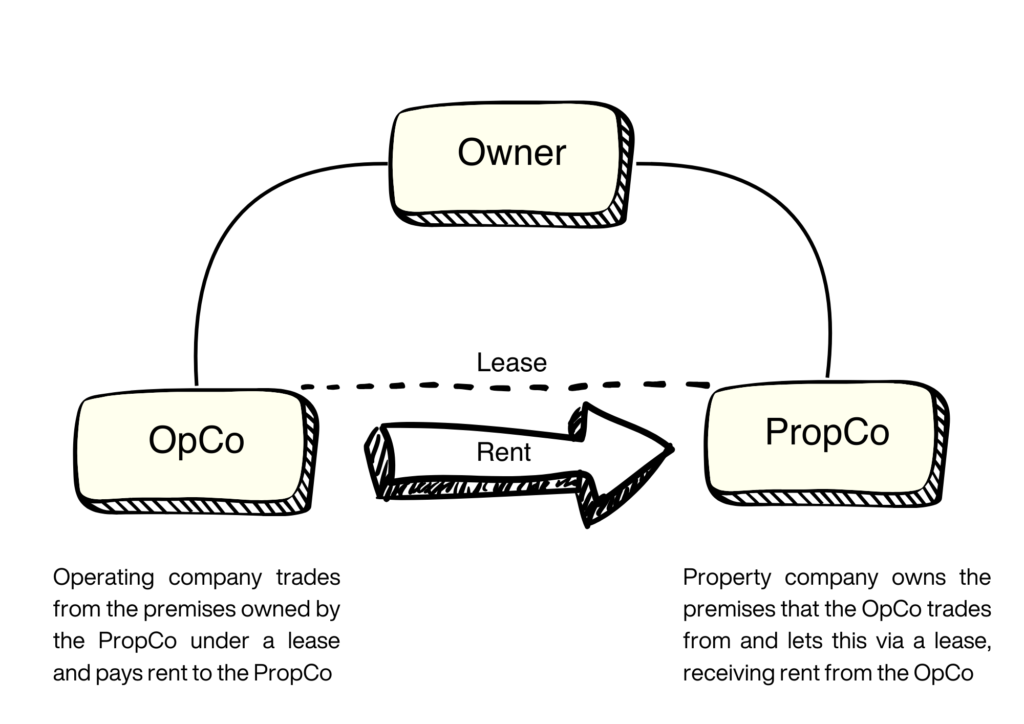

The OpCo/PropCo structure involves creating two separate legal entities: the Operating Company (OpCo) and the Property Company (PropCo). The OpCo is responsible for the core business operations, while the PropCo owns the commercial property and leases it to the OpCo. This separation creates a formal landlord-tenant relationship between the two entities.

Key Features of the OpCo/PropCo Structure

Separation of Assets: The primary feature of this structure is the division of assets. The OpCo focuses on operating activities, while the PropCo holds the real estate assets.

Lease Agreement: The PropCo leases the property to the OpCo, establishing a formal lease agreement that outlines the terms and conditions of the tenancy.

Financial Independence: Both entities operate independently from a financial perspective, allowing for distinct ownership and management of each entity.

Questions about mortgages?

Talk to one of our Property Finance Specialists about your options.

Benefits of the OpCo/PropCo Structure

This structure offers several advantages for businesses and investors, making it an attractive option for commercial property purchases. Here are some key benefits:

Asset Protection

One of the main benefits of the OpCo/PropCo structure is asset protection. By separating the operating business from the real estate assets, businesses can safeguard valuable property from potential risks associated with the operating activities. In the event of financial difficulties or legal issues, the property remains insulated from the operational liabilities of the OpCo.

Enhanced Financing Options

The separation of assets can lead to enhanced financing options. Lenders may view the PropCo as a lower-risk entity due to its ownership of tangible real estate assets. This can result in more favorable loan terms and interest rates for the PropCo, making it easier to secure financing for property purchases and improvements.

Tax Efficiency

This structure can offer tax advantages, depending on the jurisdiction and specific circumstances. Rental income generated by the PropCo may be subject to different tax treatment compared to operating income. Additionally, businesses may benefit from tax deductions related to lease payments and property depreciation.

Improved Cash Flow Management

The lease payments made by the OpCo to the PropCo can provide a steady stream of rental income, enhancing cash flow management. This predictable income can be used to service debt, invest in property maintenance, or fund future expansions.

Real Estate Value Appreciation

Commercial properties have the potential to appreciate in value over time. By holding real estate assets in a separate PropCo, businesses can capitalize on property value appreciation without exposing the operating business to market fluctuations.

Challenges of the OpCo/PropCo Structure

While there are numerous benefits, there are also certain challenges that businesses need to consider. Here are some potential drawbacks:

Complexity in Management

Implementing and managing an OpCo/PropCo structure can be complex. It requires careful planning and coordination between the two entities, including the creation of legal agreements, financial reporting, and compliance with regulatory requirements.

Higher Administrative Costs

The separation of entities can lead to higher administrative costs, including legal fees, accounting services, and property management expenses. Businesses need to weigh these costs against the potential benefits to determine if the structure is financially viable.

Potential Conflicts of Interest

The landlord-tenant relationship between the OpCo and PropCo can create potential conflicts of interest. Disputes may arise over lease terms, rental rates, and property maintenance responsibilities. Clear and well-defined agreements are essential to mitigate these risks.

Financing Challenges for OpCo

While the PropCo may benefit from enhanced financing options, the OpCo may face challenges in securing financing for its operating activities. Lenders may require additional security or debentures, which could impact the overall financial strategy of the business.

OpCo/PropCo Commercial Mortgage

An OpCo/PropCo commercial mortgage differs from a regular commercial mortgage in a few key ways due to the unique structure and objectives of the OpCo/PropCo arrangement.

Separation of Entities

In an OpCo/PropCo structure, the property ownership is separated from the operating business. The PropCo owns the commercial property and leases it to the OpCo, which operates the business. This separation creates distinct legal and financial entities. In this scenario a lender will assess the financial viability of the operating company to consider whether the mortgage is affordable. In essence they will model the mortgage as if the OpCo/PropCo structure didn’t exist, assessing whether the cash generated directly from the OpCo is sufficient to meet the mortgage commitments.

Additional Security

Due to the legal structure lenders will more often than not require a company guarantee from the OpCo as well as debentures, in additional to a first legal charge over the property. This security structure will give the lender recourse to the OpCo in the event of default giving them the best conditions for recovering their debt.

Lease Agreements

A fundamental aspect of the OpCo/PropCo structure is the lease agreement between the OpCo and PropCo. The PropCo acts as the landlord, leasing the property to the OpCo (tenant). This lease arrangement provides a steady stream of rental income for the PropCo, which can be used to service the mortgage. In contrast, a regular commercial mortgage does not involve an internal lease agreement, as the property-owning entity is also the operator.

Key Considerations for Implementing an OpCo/PropCo Structure

Before adopting an OpCo/PropCo structure for purchasing commercial property, businesses should carefully evaluate several key considerations. Here are some important factors to keep in mind:

Legal and Regulatory Compliance

Ensure that the OpCo/PropCo structure complies with all relevant legal and regulatory requirements in your jurisdiction. This includes creating formal legal entities, drafting lease agreements, and adhering to tax regulations. Consulting with legal and financial advisors can help navigate the complexities of compliance.

Financial Analysis and Feasibility

Conduct a thorough financial analysis to assess the feasibility of the OpCo/PropCo structure. Consider factors such as property acquisition costs, potential rental income, financing terms, and administrative expenses. A detailed financial plan can help determine if the structure aligns with your business goals and financial capabilities.

Clear and Comprehensive Lease Agreement

Draft a clear and comprehensive lease agreement that outlines the terms and conditions of the tenancy between the OpCo and PropCo. The agreement should address key aspects such as rent, lease duration, maintenance responsibilities, and dispute resolution mechanisms. Well-defined terms can help prevent conflicts and ensure a smooth landlord-tenant relationship.

Risk Management and Contingency Planning

Implement risk management strategies and contingency plans to address potential challenges associated with the OpCo/PropCo structure. This includes mitigating financial risks, addressing potential conflicts of interest, and ensuring business continuity in the event of unforeseen circumstances.

Ongoing Monitoring and Review

Regularly monitor and review the performance of both the OpCo and PropCo to ensure that the structure continues to meet your business objectives. This includes assessing financial performance, property value appreciation, and compliance with lease terms. Periodic reviews can help identify areas for improvement and ensure the long-term success of the structure.

Wrap Up

The OpCo/PropCo structure is a strategic approach that offers numerous benefits for businesses looking to purchase commercial property. By separating the operating business from the real estate assets, businesses can enhance asset protection, improve financing options, achieve tax efficiency, and capitalize on property value appreciation. However, it is important to carefully consider the challenges and complexities associated with this structure, including higher administrative costs, potential conflicts of interest, and the need for clear legal agreements.

Before implementing an OpCo/PropCo structure, businesses should conduct a thorough financial analysis, ensure legal and regulatory compliance, and seek advice from legal and financial professionals. By taking these steps, businesses can make informed decisions and maximize the value of their commercial property investments.

Want Some Advice?

Talk to one of our Commercial Mortgage Specialists about your options.